Sports Gambling Investment

Sports Trading is essentially an advanced form of Sports Betting – a discipline a lot of people consider to be simple gambling, which is obviously a negatively charged word in most people’s minds, certainly if it is being discussed in the context of investing. The facts are, however, that some actually make a living even on Sports Betting. Even the greatest gamblers in the world don’t rely on luck. They’re not just innately lucky people. And it isn’t luck that investors were recently given the opportunity to score big on sports betting stocks. In May 2018, the U.S. Supreme Court deemed the Professional and Amateur Sports Protection Act (PASPA) was unconstitutional. This sent shockwaves across the country and created all these new frontiers and these new markets.

Sports betting is traditionally seen as a gamble, and most people who bet on sports are certainly gambling. Our approach here at ScoreMetrics is different – we look at sports betting as an investment.

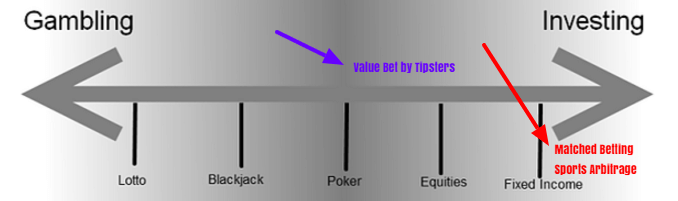

Let’s define the terms. Investing is the act of allocating capital to assets with the goal and expectation of generating a profit. Good investing involves research, risk analysis, managing capital responsibly, and diversifying investments. Successful investors follow a long-term strategy or a system that matches their goals and tolerance for risk, and they follow that system non-emotionally.

Gambling, on the other hand, is staking money in uncertain outcomes that involve a high amount of chance. In other words, gamblers mostly rely on luck instead of research. Most people gamble for fun here and there.

Investing is often associated with the stock market or with real estate. Gambling comes to mind when we think of casinos, poker games with friends, and betting on sports.

But it’s certainly possible to gamble in the stock market. Making uninformed trades in hope of turning a quick profit is not investing – it’s gambling. And as you probably guessed by now, it’s also possible to invest in sports betting. Having a proven system in place and acting strategically and non-emotionally is investing, not gambling.

In this report, the ScoreMetrics Lab gives you an overview of sports betting as an investment and draws comparisons to the stock market.

When you look at them at their most fundamental, base level, sports betting and the stock market reward players for successfully predicting the future. Much like the stock market, successful sports betting isn’t all about wins and losses (ie. stock prices going up and down). It’s about following a system that generates profit over an extended period of time.

Sports Betting Investment Fund

It’s not considered a win if you bought stock in Amazon last week and the stock price is up 5% today. You’re not cashing in and telling all your friends that you’re a winning investor. Just like you won’t call yourself a loser if the stock went down 5% the next week.

Instead, you’re following a strategy. Maybe you believe that Amazon will beat the S&P 500 returns over the next 5 years and that’s the minimum amount of time you’re going to hold on to the stock. You probably have a bunch of other stocks in your portfolio as well that share a similar investment hypothesis.

In similar fashion, following a sports trading system is not about the individual wins or losses of a single trade. You’re executing a number of trades based on your investment hypothesis, and you’re measuring success over a long period of time – for a full season, for example.

Successful long-term investing in sports requires diversified systems, an intricate unit allocation model, careful bankroll management, keeping detailed records, a cool head, and constant>

Sports books have a lot of similarities to the stock market. They are marketplaces where investors have the opportunity to invest capital in future results. And just like in the stock market, there are loads of those opportunities available and most of them aren’t that great. Investors need to be smart about choosing their spots.

In essence, bookmakers act as marketplaces that take bets on both sides of contests and make their money by taking a “vig” off of each trade. They use various models to calculate probabilities for each result and adjust their odds accordingly.

This is pretty similar to futures or options in the stock market, which investors often use to speculate whether a stock price will go up or down over a certain period of time. The marketplace offers investors the chance to “bet” on both sides and takes their cut in form of a fee for each trade.

So where are the good opportunities in the sports betting market?

At ScoreMetrics, we find these by exploring hundreds of hypotheses and conducting thorough research to find out if we have something in our hands that meets our rigorous criteria. We create rules, analyze every piece of relevant data we can find, and backtest our theories to make sure that they’re profitable over long periods of time.

To quote our very own John Todora from his new book, “Zero Correlation Investing – The Score Metrics Secret”:

”In short, ScoreMetrics is a method of speculating on sports in the same way you speculate on stocks, but, just like with other investments, the method uses back-tested analytics to find patterns that show a significant return on investment (ROI), while limiting risk.”

The book is on sale for a limited time, so now’s a great opportunity to dig deeper and learn all you need to know about sports betting as an investment.

Also make sure to keep coming back to https://sportstradingsystems.com/ for regular quality analysis on current sports investment topics – we’re here for you!

The ScoreMetrics Lab is the engine that runs the Sports Trading System operation, consisting of a team of researchers and writers who are constantly testing and retesting algorithms. They work hand in hand with our Head Trader and Creator of ScoreMetrics, John Todora to help find new breakthroughs and develop new systems.

What is Sports Betting?

by Tim Maloney / May 15th, 2020

Sports betting is the activity of placing wagers on predicting the results of sporting events. As of 2018, sports betting represented approximately 18% of the $449 billion global gaming market, as measured by gross gaming revenues, or “GGR”. In terms of the sports upon which wagers are placed, popularity varies significantly from region to region. Goldman Sachs expects the online sports betting market to grow 7.1% per annum from 2018 to 2022.

Source: Goldman Sachs Global Investment Research

Sports Gambling Investing

What is iGaming?

/SportsBetting-58d2b6195f9b584683b46637.jpg)

iGaming or “online gaming” is broadly defined as: the wagering of money or some other value on the outcome of an event or a game, using the internet. This includes online sports betting, as well as online casino games and poker. In 2018, online represented 11.3% of the total market. This is expected to grow as improved regulation allows for more betting to take place via the internet.

Source: H2 Gaming Capital

Is Sports Betting legal?

Regulated sports betting is currently legal in several European countries, Australia, and Mexico. In the United States, legalization is enforced at the state level. In May 2018, New Jersey successfully won a court ruling to legalize sports betting in the state, paving the way for additional States to receive approval. Several additional States have since received regulatory approval, while additional States continue to work towards legalization. On a country level, Brazil and India represent two examples of countries that are moving towards potential regulation.

Source: DraftKings IR

Why invest in Online Sports Betting & iGaming?

The global gaming industry is evolving from a “brick and mortar” to “online” business. From 2015 to 2018, online revenues increased at a 15% annualized rate -- from $38 billion to $51 billion. We expect online to earn an increasing share of the $400+ billion gaming market.

Source: DraftKings IR

U.S. Online Betting Market

Growth in the US market is expected to increase as the regulatory environment evolves state by state. Ellers & Kreijuk estimates that US online sports betting will reach $14 billion at maturity. However, the US currently lags behind the UK and Australia in terms of per capita gambling spend. If we estimate the market based on per capita rates in those countries, the market would reach $22 billion or $23 billion, respectively.

The Sports Betting & iGaming Ecosystem

Roundhill has identified five primary types of public companies that provide exposure to the sports betting and iGaming ecosystem — sportsbooks, technology, casinos, lead generation and iGaming.

Sportsbooks

Sportbooks’ primary business is owning and operating online and/or land-based sportsbooks. In several cases, these companies are vertically integrated, whereby they own the underlying technology. Sportsbooks derive revenue from collecting a commission on bettors’ losing bets.

Technology

Technology companies include both B2B and B2C betting technology providers. These companies license their software and data to online sportsbooks and land-based gaming operators.

Lead Generation

Lead Generation companies involved in iGaming and sports betting are focused on marketing and sales lead generation. They provide a “top of funnel” for iGaming and Sportsbook customers.

iGaming

iGaming companies’ principal business is online gaming, focused on casino games such as poker, blackjack, and roulette. In some instances, these companies may be expanding their presence in sports betting.

Casinos

As the name suggests, Casino companies’ primary business is owning and/or operating brick and mortar casinos. Several Casino operators are investing into online-based gaming, including both iGaming and sports betting.

Looking for more Sports Betting content?

For more information, please visit roundhillinvestments.com or follow us on twitter @roundhill.